By Dana M. Grimes, Esq.

Bad borrowers are not the only ones at fault for the collapse of the real estate market in 2008; top banking officers approved of billions of dollars of loans to borrowers who could not repay them, bundles of toxic mortgages were rated as AAA securities by Moody’s and S & P, the SEC and other regulators were asleep at the switch.

Bad borrowers are not the only ones at fault for the collapse of the real estate market in 2008; top banking officers approved of billions of dollars of loans to borrowers who could not repay them, bundles of toxic mortgages were rated as AAA securities by Moody’s and S & P, the SEC and other regulators were asleep at the switch.

In this article, I will summarize the mortgage fraud cases we have been working on recently, with an emphasis on the types of fraud the U.S. Attorney’s office is most interested in prosecuting.

False Statements

Fraudulent practices were so systemic in the mortgage industry, it would be impossible to charge everyone guilty of it. Generally speaking, all mortgage fraud prosecutions allege some type of knowingly or recklessly made material misstatement relied upon by a bank to fund, purchase or insure a loan. (Bank Fraud is codified at Title 18, U.S.C. Section 1344, and is often charged along with wire fraud and mail fraud, and in some cases, money laundering)

When it comes to bank fraud, prosecutors are more interested in perpetrators of fraud for profit than fraud for housing. If your client, at the urging of her mortgage broker, overstated her income on a loan application to qualify for her dream home, which she then diligently made mortgage payments on but eventually lost to foreclosure when her A.R.M. adjusted, she will probably not be indicted. However, if she bought 10 properties by providing false income information to banks, secured 100% financing, and then let the properties go into foreclosure, she is in trouble.

STRAW BUYERS- Often, the crime is a bit more complicated than that, involving straw buyers on the loan instruments and shell companies to launder the loan money through, but the fraud is still usually pretty easy to prove. The prosecutors just compare the information provided to the lenders with other documents (such as tax returns). To prove which loan officers, real estate professionals, or other defendants aided and encouraged the borrowers in preparing and presenting the false information, the government obtains letters, faxes, emails, and any other documentation that will corroborate the testimony of their cooperating witnesses.

Property Flipping

The criminal version of property flipping is when a “flipper” purchases a property and artificially inflates its value through false appraisals. The artificially valued properties are then sold to an associate of the flipper at a substantially inflated price. Flipped properties then go into foreclosure and are ultimately repurchased for a fraction of what the bank loaned the flipper (who is long gone).

Law enforcement has developed new technology to detect this type of fraud. For example, according to the FBI, someone at their Washington Field Office designed an analytical computer application that detects the names of companies and people with patterns of property flipping. Suspicious flippers are flagged for further criminal investigation.

Widespread fraud in the home loan industry

Mortgage industry insiders, such as mortgage brokers, appraisers who overrode lending controls, are of interest to the Government.

Mortgage fraud prosecutions are often multi-defendant cases involving bank officers who falsely verified deposits in banks, escrow agents who lost their independence, and appraisers who inflated the value of homes to get a kick back. Everyone, at every level of the fraud, got a piece of the pie when the loan funded. The profitability and relative ease of committing mortgage fraud during the peak of the real estate bubble has created unusual indictments (for example a case in federal court in San Diego where an accounting firm was charged with conspiring with members of a street gang).

Conspiracy charges are common in these situations. Note: it is bad sign for your client when the FBI agent you are talking to starts referring to your client and her friends as an enterprise.

Heavy advertising for mortgages and refis was done with seminars, the internet, boiler rooms telemarketing, and with direct mail. Many of the purchasers of these loans had very low credit scores – and mortgage brokers earned large commissions selling these people what the industry refers to as a liar loan (inflated stated income and assets), an exploding loan (the A.R.M. that will be adjusting – or exploding – over the next few years), or a ninja loan (no income, no job, no assets).

The illegal part involves falsifying the income to debt ratios, verifying assets or income that do not exist, and otherwise putting customers into houses you know they cannot afford. Agents and brokers who worked in jobs like this are of interest to the U.S. Attorney’s office. The indictments in these cases include bank fraud, mail fraud, wire fraud, conspiracy, and in some cases, money laundering.

Mortgage Mitigation Fraud and Loan Modification Fraud

A certain segment of the population adapts with alarming ingenuity to the changing economy – now the same individuals who were talked into misstating their assets to banks or tricked into selling their credit are being contacted as their houses go into foreclosure. Some companies (and some lawyers), promise consumers facing imminent home foreclosure that they can stop the foreclosure, regardless of the amount the consumer owes his or her lender. These companies typically charge consumers an up-front fee of $1,500 to $2,500 but, the FTC alleges, do little or nothing to help people avoid foreclosure. When colleagues ask us how to avoid getting in trouble in the mortgage mitigation business, we tell them it is easy, stay out of it. In addition to criminal prosecution of these cases, the State Bar and the California Department of Justice have been active in suing attorneys involved in fraudulent mortgage mitigation. In November, 2011, the State Supreme Court declined to hear the case of attorney Phillip Kramer of Calabasas, who was among the attorneys sued by the DOJ for allegedly defrauding thousands of homeowners by collecting up front fees of $3,500 to $10,000 for mortgage relief that was never provided.

Armed Accountants

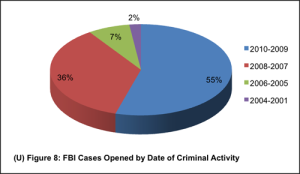

Between 2007 and 2009, the FBI doubled the number of Special Agents assigned to investigate mortgage fraud. The number of open investigations has tripled in the last three years. Currently, according to FBI Director Robert Mueller, the FBI has more than 2,600 cases open, with most of them involving losses of over $1 million. In the coming months, you may need to warn certain business clients who have been involved in the real estate industry that they may receive a call from the FBI, a grand jury subpoena, or, in some cases, a home or office visit from a group of federal agents with guns, accounting degrees and a search warrant.

The United States Department of Justice launched a nationwide program “Operation Stolen Dreams.” It is being implemented aggressively in San Diego, by the local US Attorney’s office and FBI. Dozens of defendants have been indicted in San Diego for mortgage fraud related federal crimes, including falsifying loan applications to defraud lenders as well as fraudulently selling loan modification services to homeowners who are delinquent on their mortgage payments. After 9/11, there had been a reallocation of FBI agents from fraud cases to the investigation of leads in terrorism cases, but new FBI white collar positions have been created to deal with the mortgage fraud investigations. In addition to assigning more assistant US Attorneys to the prosecution of white collar cases, the United States Department of Justice has emphasized its prosecution of individuals, such as CEOs, executives, and house counsel, in cases involving criminal activity by corporations. When there is strong evidence against these individuals, it is hard to get cases against them dismissed by negotiating a plea of guilty by the corporation.

Short sale fraud- Federal agents and prosecutors are investigating real estate brokers and agents suspected of short sale fraud. As many as 40% of short sales that are sold for a profit within 6 months may involve criminal fraud. In the typical fraud, the agent persuades a homeowner to sell to an investor who is in collusion with the agent. The agent persuades the bank to authorize the short sale, concealing the relationship between the agent and the investor (and sometimes concealing the fact that sale to another end buyer has already been arranged at a much higher price than the short sale. Meanwhile, even though lenders are much stricter now than they were five years ago, as many as 33% of loans investigated post funding in 2010 involved some type of appraisal fraud or other misrepresentation. There are going to be more real estate agents, loan officers, appraisers, etc. going to jail after the present wave of prosecutions from the days of the real estate bubble.

The US Attorney’s office in San Diego continues to prosecute these cases aggressively. Twenty-six indicted defendants in one case alone were indicted in the case of United States v. Berkenfield, et al. Each new indictment leads to future indictments, as some of the defendants in each case will enter into cooperation agreements with the government, in the hope of reducing the time they will spend in federal prison. These cooperating defendants then tell the government everything they know about other people in the mortgage industry who engaged in illegal practices, and many of these people are caught up in the next wave of indictments. These cases leave a paper trail, so the testimony of cooperating defendants can often be supported by documentary evidence

Ironically, in 2014 there was a growing bubble in sub prime auto loans, which is similar in many ways to the real estate bubble. Car buyers with bad credit were encouraged to buy cars they could not afford, often with false loan applications. The interest rates were sometimes as high as 24%, and many of these cars were repossessed by the lenders. In some cases, the lenders had the ability to shut down the ignition system of the car by remote control once the buyer stopped making payments. The loans were packaged and securitized and sold to investors, much in the same way real estate loans are. This flawed system will cause financial damage to a lot of car buyers, but it is not going to cause collapse of the economic system the way explosion of the real estate bubble did.

After the bail out of banks by the federal government, billions of dollars of packages of subprime loans have been marketed at great discounts. In some cases, the FBI and the Department of Justice allege that the purchasers of bundles of subprime loans in some cases have paid kickbacks to mid level employees of a number of major banks, for opportunities to buy packages of loans at less than fair value. There are going to be arrests and prosecutions of both the buyers of these loans and the bank employees taking kickbacks.